Highlights:

- Total properties sold : 2,423 in May through the Board’s Multiple Listing Service® System, compared with 2,271 in May 2018, an increase of 6.7 per cent.

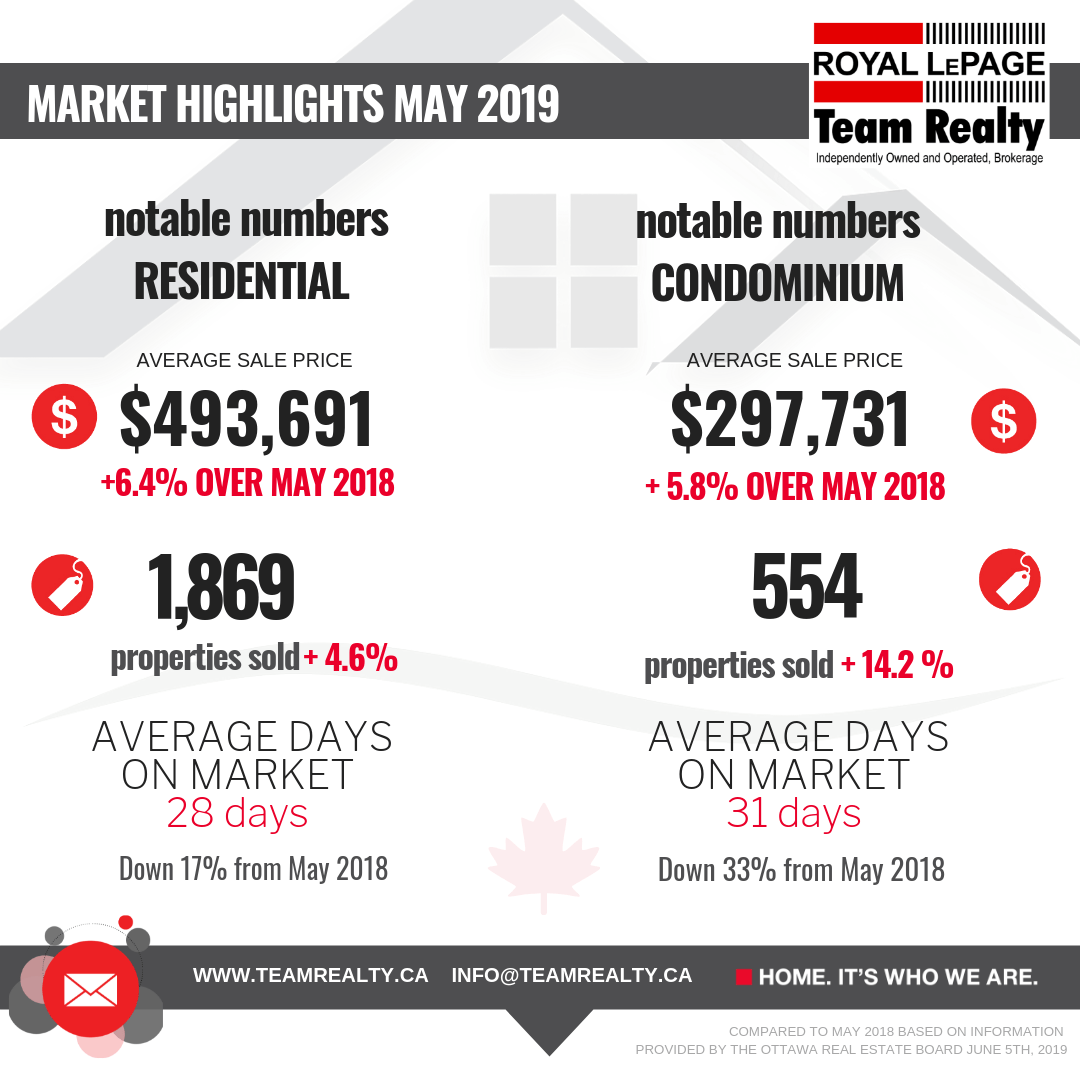

- May’s sales included 1,869 in the residential property class, an increase of 4.6 per cent from a year ago.

- 554 in the condominium property class, an increase of 14.2 per cent from May 2018.

- The five-year average for May unit sales is 2,167.

- Average sale price for a condominium-class property was $297,731, an increase of 5.8 % over May 2018

- Average sale price of a residential-class property was $493,691, a rise of 6.4% over May 2018

- Most active price points Residential: $350,000 to $499,999 price range was the most active price point in the residential market, accounting for 42% of sales while 28 per cent of residential sales were in the $500,000 to $749,999 range.

- Most active price Condominium market, which increased to the $225,000-$349,999 price range two months ago, accounts for 57 per cent of the units sold.

Blossoming Condo Market Bolsters May Resales

June 5, 2019

Members of the Ottawa Real Estate Board sold 2,423 residential properties in May through the Board’s Multiple Listing Service® System, compared with 2,271 in May 2018, an increase of 6.7 per cent. May’s sales included 1,869 in the residential property class, an increase of 4.6 per cent from a year ago, and 554 in the condominium property class, an increase of 14.2 per cent from May 2018. The five-year average for May unit sales is 2,167.

“Despite the continuous free fall of inventory levels, we still have a higher sales volume than this time last year,” observes Dwight Delahunt, Ottawa Real Estate Board’s President. “Well-priced and positioned properties are turning over quickly with residential days on market declining 17 per cent on average from 34 to 28 days from last May and a whopping 33 per cent decrease for the condominium market from 46 days to 31 days.”

“Condo sales are bolstering the resale market, up 14 per cent from a year ago, and are providing an excellent opportunity for those Buyers wishing to enter the market or who are ready to downsize,” he adds.

May’s figures show the average sale price for a condominium-class property was $297,731, an increase of 5.8 per cent from last year while the average sale price of a residential-class property was $493,691, a rise of 6.4 per cent from a year ago. Year to date numbers show a 6.6 per cent and 7.9 per cent increase in average prices for residential and condominiums respectively.*

“Home prices are steadily increasing at a reasonable rate, and the fact that they are not spiking confirms that our market is healthy and sustainable,” Delahunt points out. “Although we hear about extreme multiple offer situations, the reality is, 62 per cent of homes are still selling at or below asking.”

“Certainly, there are 15 per cent more listings selling above asking compared to this time last year, but these are restricted to particular pockets of the city. There are still many opportunities for those who want to find an affordable property. This is where the knowledge and experience of a REALTOR® will serve you well. They understand Ottawa’s neighbourhoods, market trends, and property values and can efficaciously guide you in your home sale or search,” Delahunt advises.

The $350,000 to $499,999 price range was the most active price point in the residential market, accounting for 42 per cent of May’s transactions while 28 per cent of residential sales were in the $500,000 to $749,999 range. The most prevalent price point in the condominium market, which increased to the $225,000-$349,999 price range two months ago, accounts for 57 per cent of the units sold.

In addition to residential and condominium sales, OREB Members assisted clients with renting 1,043 properties since the beginning of the year.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.