When you decide to buy your first home, the initial excitement is often quickly followed by fear of the unknown. After viewing many attractive properties online, you have no idea where to start. Eventually, though, with the invaluable assistance of a real estate agent, you can purchased your dream home at a great price. Those who have experienced a number of property transactions realize just how many reasons they have to be thankful for the trusting relationship they developed with their agent. First, the money and time you save far exceeds the agent’s commission. From planting the For

Read More

Monthly Archives March 2016

Time To Get Out The Spring Maintenance Checklist

In Ottawa, there are two sights that remind homeowners it’s time for spring maintenance: bikes on the road and geese in the sky. With the recent double-digit temperatures, it seems spring has won its annual wrestling match with winter. And, as spring fever sets in, you may want to store your parka and get at those spring maintenance chores. A great place to start is making sure the melting snow and runoff flows freely off your roof and away from your home instead of seeping in or collecting at the foundation. Improper drainage can cause problems like foundation flooding,

Read More

Financing Your Home Purchase – Mortgage Broker or Bank?

When it comes time to purchase a new home, where should you go for financing? You may have a relationship with a bank from past transactions (RRSPs, savings accounts, car loan), so it’s the first option that comes to mind. But, mortgage brokers are licensed specialists who have access to many lenders and mortgage rates, so they may be a better choice. Here are some pros and cons for each. Advantages of Mortgage Brokers do all the negotiating for you to find the lowest rate have knowledge of, and access to, the entire mortgage market have exclusive

Read More

Financing Your Home Purchase – Mortgage Broker or Bank?

When it comes time to purchase a new home, where should you go for financing? You may have a relationship with a bank from past transactions (RRSPs, savings accounts, car loan), so it’s the first option that comes to mind. But, mortgage brokers are licensed specialists who have access to many lenders and mortgage rates, so they may be a better choice. Here are some pros and cons for each. Advantages of Mortgage Brokers do all the negotiating for you to find the lowest rate have knowledge of, and access to, the entire mortgage market have exclusive

Read More

7 Deadly Sins of Home Renos

Homeowners who renovate only to boost resale value should aim for a return on investment (ROI) of three dollars for every dollar invested. Resale renos should be neutral in colour and conservative in tone so they appeal to the maximum number of potential buyers. And, cost control always trumps elegance. In fact, some renovations can actually damage your home’s value. These supposed improvements not only add nothing to your bottom line, they may make your home less attractive to potential buyers and bring down its value. Here are seven such expensive mistakes to avoid. Pools A pool

Read More

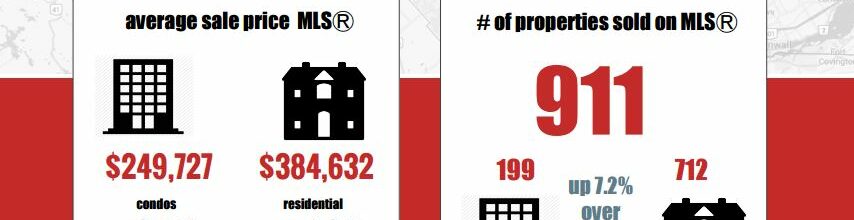

Real Estate Snapshot February 2016

What a difference a day makes! An extra day in February saw 46 sales on that day (February 29th) as per the Ottawa Real Estate Board’s news release March 3rd. See the full Ottawa Real Estate market snapshot for February and the full story from the Ottawa Real Estate Board below. With spring around the corner, we’re starting to see more homes come on the market, if you’re thinking of selling now is a great time to get your home listed with a real estate professional. While statistics are useful in establishing trends they should not be used as

Read More

Saving Strategies for Every Age

We all want to save more money, but doing it requires a plan. And, the best approach to saving depends on the stage of life you’re in because each phase has unique financial commitments. Although individual circumstances vary, these generation-specific suggestions will point you in the right direction. Millennials (19-35) Millennials, born between 1980 and 1996, are actually better than Gen Xers at money management, according to financial journalist Vera Gibbons. But, they tend to live in the moment and prefer instant gratification to long-term financial planning. And, because personal finance is not a core subject in

Read More